Patents stifle innovation.

Patent trolls are the modern day robber barons.

All patents are acquired by large corporations who operate to destroy small businesses.

These statements reflect the views of many individuals regarding patents and patent owners. Whether you agree or disagree with these statements, I have no intention to change your mind. However, there is one aspect of patents in which I would like to discuss, namely the effect of patent policy in the promotion of job growth.

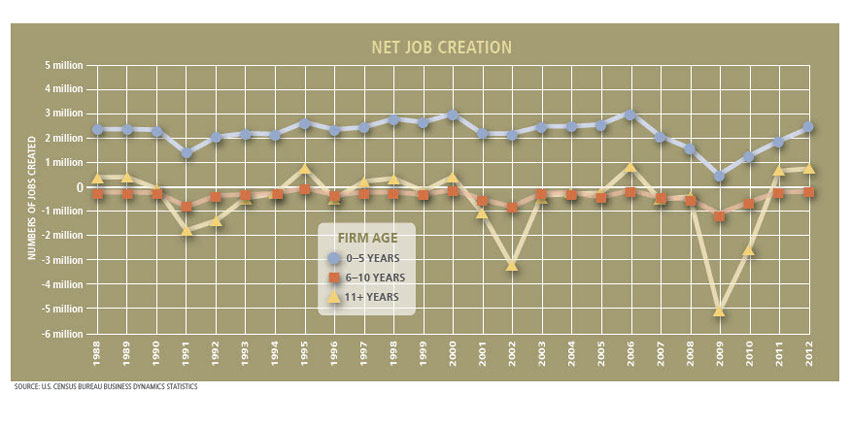

New and young companies, generally referred to as startups, are the primary source of jobs in the United States. Startups are commonly considered to be those companies in existence for less than six years. The chart below details net creation of jobs amongst companies of different ages from 1988-2012 where companies of an age of 0 to 5 years have consistently led net job creation, even in the post dotcom crash of 2001 and post housing crash of 2008. This chart is reproduced from The Importance of Young Firms for Economic Growth by Jason Wiens and Chris Jackson of the Ewing Marian Kaufman Foundation, September 13, 2015.